Ultimate Guide to AI-Powered Compliance Reporting

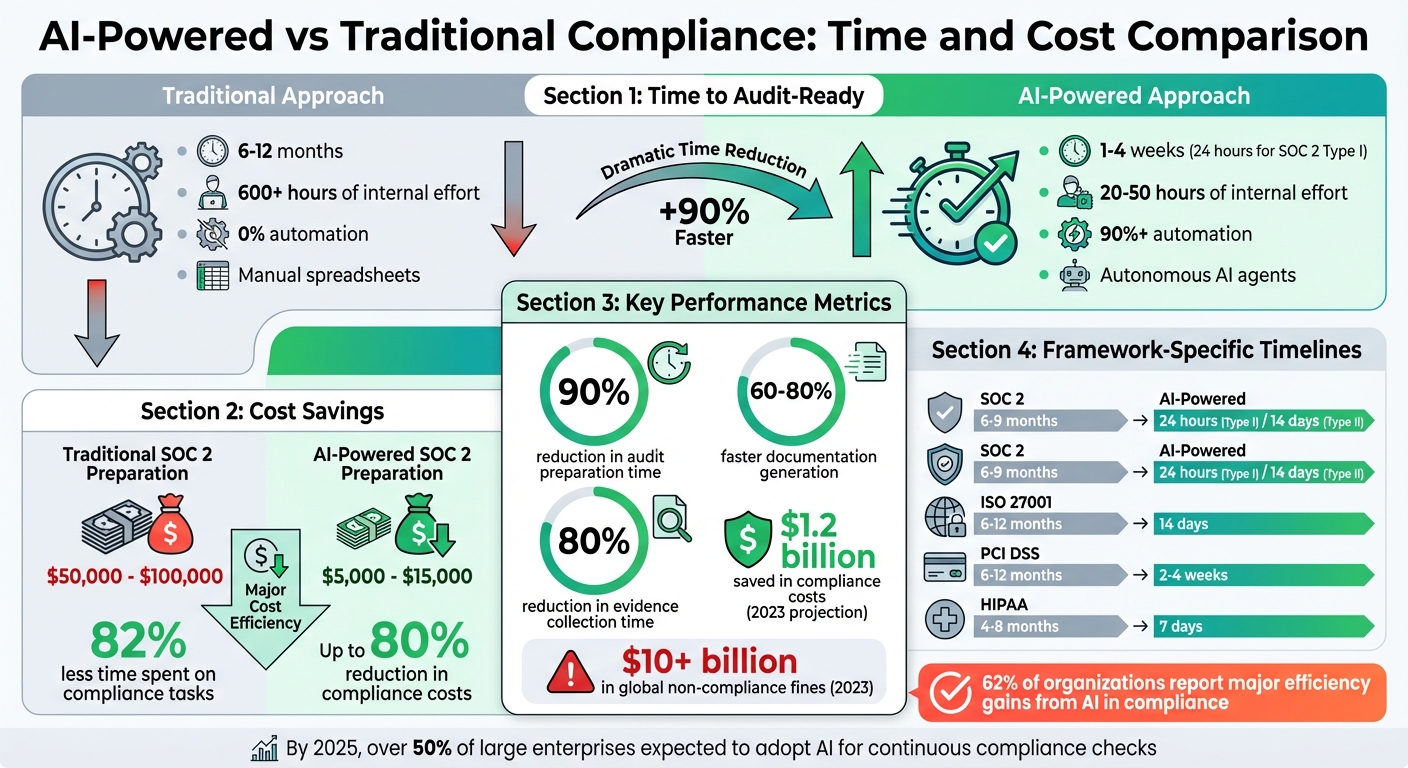

AI-powered compliance reporting is changing how businesses manage regulatory requirements. It automates evidence collection, analyzes legal documents, and ensures real-time monitoring for frameworks like SOC 2, ISO 27001, HIPAA, and PCI DSS. By connecting directly to systems like AWS and GitHub, AI tools reduce manual work, cut audit preparation time by 90%, and help organizations stay audit-ready.

Key benefits include:

- Faster compliance: SOC 2 readiness in 24 hours vs. months manually.

- Cost savings: Reduces compliance costs by up to 80%.

- Improved accuracy: Decreases errors and false positives significantly.

- Streamlined reporting: Automated dashboards and reports tailored for auditors.

With global non-compliance fines exceeding $10 billion in 2023 and stricter regulations like the EU AI Act, adopting AI for compliance is more critical than ever. However, human oversight remains essential to avoid errors and ensure reliability. Platforms like The Security Bulldog even enhance compliance by integrating external threat intelligence into reporting workflows.

AI is not just a tool – it’s becoming a necessity for efficient, real-time compliance management.

AI-Powered vs Traditional Compliance: Time and Cost Comparison

Core Concepts and Regulatory Landscape

Understanding Governance, Risk, and Compliance (GRC)

At its core, Governance defines the leadership structure, policies, and accountability measures that keep an organization secure. It clarifies decision-making processes, documents those decisions, and assigns responsibility when challenges arise. Risk focuses on identifying and addressing potential threats like ransomware attacks or data breaches before they escalate. Compliance, on the other hand, ensures adherence to external regulations (such as SOC 2 or HIPAA) and internal standards.

In the past, GRC relied heavily on periodic audits. Now, AI has transformed this space by automating workflows, interpreting regulations, and suggesting actionable steps. For instance, when new regulations like NIS2 or CCPA are introduced, AI tools can quickly analyze the requirements and align them with an organization’s existing controls. Continuous Control Monitoring (CCM) takes this further by providing real-time oversight, moving beyond traditional one-time checks.

The benefits of AI in GRC are tangible. By 2025, more than half of large enterprises are expected to adopt AI for continuous compliance checks. Already, 62% of organizations report major efficiency gains in compliance processes thanks to AI, and by 2023, AI-powered RegTech solutions were projected to save businesses around $1.2 billion in compliance costs. With automation capable of taking over as much as 80% of an employee’s manual tasks, the advantages are hard to ignore.

"AI will continue to reshape the GRC landscape. We can expect to see advancements in areas like anomaly detection, predictive analytics, and automated regulatory reporting." – McKinsey & Company

This evolving regulatory environment highlights the importance of understanding key compliance frameworks.

Overview of Key Compliance Frameworks

Several compliance frameworks serve as benchmarks for organizations aiming to meet regulatory and security standards.

- SOC 2: Widely regarded as the standard for SaaS companies, SOC 2 was developed by the American Institute of CPAs (AICPA). It evaluates five Trust Services Criteria: Security, Availability, Processing Integrity, Confidentiality, and Privacy. SOC 2 reports come in two types: Type I assesses the design of controls at a specific point in time, while Type II evaluates how effectively those controls operate over a period.

- ISO/IEC 27001: This international standard focuses on establishing an Information Security Management System (ISMS) through structured risk assessment and treatment, setting a global benchmark for information security.

- HIPAA: A U.S. federal law requiring healthcare organizations and their partners to protect Protected Health Information (PHI) through strict safeguards.

- PCI DSS: Applicable to entities handling cardholder data, this standard mandates robust access controls and continuous monitoring to ensure data security.

As regulations evolve, new mandates like the SEC’s stricter incident disclosure rules highlight the growing need for efficient compliance solutions.

Automation platforms are stepping up to meet these demands, with some claiming to accelerate compliance processes by 90% and achieve perfect audit success rates . AI tools are proving indispensable in streamlining these frameworks, as explored in the following use cases.

AI Use Cases in Compliance Reporting

AI-powered tools are revolutionizing compliance reporting by automating complex and time-consuming tasks. These systems integrate seamlessly with platforms like The Security Bulldog to deliver smarter, faster results.

- Natural Language Processing (NLP): NLP tools can extract regulatory obligations from dense legal documents and convert them into actionable tasks. For example, instead of manually sifting through regulatory updates, NLP can identify relevant changes and map them to an organization’s existing controls. This functionality is especially useful for Regulatory Change Management (RCM), where AI monitors thousands of sources – such as the SEC, FTC, and state agencies – and delivers critical updates directly to compliance teams.

- Machine Learning: By analyzing historical data, machine learning predicts risks, identifies compliance gaps, and detects fraud patterns before they become violations. Case studies show that AI-driven compliance tools can significantly cut costs and reduce errors .

- Automated Evidence Collection: Through API integrations, AI tools connect directly to infrastructure like AWS to continuously gather and validate data. This reduces evidence collection time by up to 80% and minimizes manual mistakes.

- Intelligent Documentation: Using NLP, AI systems can generate detailed, framework-specific reports in a fraction of the time, cutting production timelines by 60-80%.

Despite these advancements, human oversight remains critical. In July 2025, a Colorado defamation case revealed the pitfalls of over-reliance on AI. Two attorneys were fined $3,000 each for submitting a court filing generated by AI, which included over 20 fabricated case citations. This incident underscores the importance of using AI to enhance, not replace, human expertise. Expert-in-the-loop systems are essential for ensuring accuracy in regulatory compliance and decision-making .

Building an AI-Driven Compliance Reporting Stack

Components of an AI-Powered Reporting System

An AI-driven compliance reporting system is made up of five key layers that work together to streamline how evidence is gathered, monitored, and reported. At its core, automated evidence collection connectors link directly to existing tools and services like AWS, GCP, Azure, Okta, Google Workspace, Workday, GitHub, and Jamf. These connectors use APIs to pull configurations and proof of controls, removing the need for manual evidence collection.

At the heart of the system is the AI analytics engine. This engine uses autonomous agents to navigate older systems, gather documentation, and even draft policies. Machine learning algorithms monitor for anomalies in real time, while natural language processing (NLP) creates narratives tailored to specific compliance frameworks. Modern platforms can integrate new data sources in as little as 10 minutes.

A centralized control mapping repository acts as a library, linking technical rules to multiple regulatory frameworks. For instance, a single control like multi-factor authentication can meet requirements for SOC 2, ISO 27001, HIPAA, and GDPR simultaneously. The continuous monitoring layer ensures around-the-clock oversight, with some systems checking hourly for issues like disabled MFA or exposed S3 buckets. Finally, reporting dashboards and trust centers provide auditor-specific portals and public-facing certification updates, showcasing live evidence logs and security policies.

| Component | Technical Function |

|---|---|

| Data Ingestion | Connects to AWS, Okta, GitHub, and HRIS using APIs |

| AI Analytics | Leverages NLP and RAG to analyze threats and draft compliance narratives |

| Control Repository | Links technical rules to frameworks like SOC 2 and NIST |

| Reporting Dashboard | Produces audit-ready documents and real-time Trust Centers |

These systems can drastically cut the time needed for compliance preparation. For example, SOC 2 Type I readiness, which typically takes 3–6 months, can now be completed in just 24 hours. By combining deterministic code for technical checks with AI for documentation, organizations can automate over 90% of the process while reducing the likelihood of audit errors.

Next, we’ll look at how external threat intelligence can further enhance this compliance stack.

Using The Security Bulldog for Enriched Intelligence

The Security Bulldog brings an extra layer of intelligence to your compliance system by integrating curated threat insights directly into the AI analytics layer. Its NLP engine processes open-source cyber intelligence from MITRE ATT&CK, CVE databases, security podcasts, and news outlets, turning raw data into actionable insights that strengthen your compliance strategy. When paired with your reporting system, The Security Bulldog’s semantic analysis identifies emerging risks that could weaken your control effectiveness.

With organizations receiving an average of 220 regulatory alerts daily across multiple jurisdictions, manually tracking every update becomes nearly impossible. The Security Bulldog filters through this noise, delivering only the most relevant intelligence for your IT environment. This is especially beneficial for Retrieval Augmented Generation (RAG) setups, where combining internal logs with external threat data ensures context-aware responses to auditor questions.

Take, for example, a mid-sized financial services firm that, in October 2025, adopted an AI-powered compliance solution to manage SOX, GLBA, and PCI DSS requirements. By doing so, the firm significantly cut compliance costs, reduced documentation errors, and slashed data collection time.

Integrating The Security Bulldog into your compliance workflows adds critical external context, helping you map specific risks – like prompt injection or RAG poisoning – to frameworks such as OWASP and MITRE. Enhanced collaboration features also allow security and compliance teams to work together more effectively. For example, as new CVEs are published or MITRE ATT&CK techniques evolve, risk assessments are automatically updated. This creates a feedback loop where external intelligence directly informs and updates compliance documentation.

Data Flows and Reporting Formats

Once the system components are in place, clear data flows and customized reporting formats are essential for maintaining audit readiness. The process starts with data ingestion, where connectors pull information from source systems using change-data-capture (CDC) and pre-built APIs. This raw data – like configuration files, access logs, training records, and onboarding documents – is then transformed to normalize formats, timestamps, and numerical data according to U.S. standards (e.g., MM/DD/YYYY dates, comma-separated thousands, and periods for decimals).

Metadata and lineage tracking document the movement, transformation, and access of data. For AI workflows, systems must also log how data feeds into RAG implementations or model fine-tuning. Every model output is tracked to ensure there’s an auditable chain of decisions from training data to final results. Regulators often require real-time logs with precise timestamps for agent actions and data access.

The final stage generates various reporting formats tailored to different audiences. PDF reports are designed for auditors and management, while JSON and CSV files enable data sharing with regulatory bodies or internal analytics tools. These outputs include control narratives explaining how specific controls meet regulatory requirements, explainability reports documenting the logic behind AI decisions, and audit trails with timestamped logs showing how evidence was collected. Each output supports regulatory compliance and ensures continuous readiness.

"A Fortune 50 financial services firm used an AI governance platform to manage a risk surface of over 150,000 resources. By identifying misconfigured AI agents and over-shared resources, the firm achieved an 80% risk reduction across its tenant while supporting a 180% growth in agent and automation volume."

The firm’s success hinged on implementing policy-as-code, which allowed governance rules to be version-controlled and deployed alongside data pipelines for consistent enforcement.

However, these benefits depend on having a solid data infrastructure. AI agents can only deliver results if real-time data is accessible across all systems. Starting small – perhaps with a specific area like regulatory reporting or claims monitoring – can demonstrate the system’s value before scaling it up.

Automating the Compliance Reporting Lifecycle

Scoping and Requirements Mapping

The initial step in compliance reporting – scoping and mapping requirements – typically demands a significant amount of manual effort. AI simplifies this process by leveraging Natural Language Processing (NLP) to analyze complex regulatory texts and pinpoint the specific rules that apply. Instead of spending countless hours poring over lengthy regulatory documents, AI systems continuously monitor these texts, extracting only the obligations that are relevant to the organization.

AI tools also streamline the process of mapping regulatory requirements to an organization’s internal controls, procedures, and policies. For businesses juggling multiple standards like SOC 2, ISO 27001, and HIPAA, AI identifies overlapping requirements. This means a single control – such as multi-factor authentication – can satisfy multiple frameworks. This "test once, comply many times" method minimizes redundant work and ensures consistent application across certifications.

| Feature | Traditional Approach | Legacy Platforms | AI-Powered Platforms |

|---|---|---|---|

| Time to Audit-Ready | 6–12 months | 3–6 months | 1–4 weeks |

| Internal Effort | 600+ hours | 200–400 hours | 20–50 hours |

| Automation Level | 0% | 40–60% | 90%+ |

| Mapping Method | Manual Spreadsheets | Template-based | Autonomous AI Agents |

The most effective systems incorporate an Expert-in-the-Loop (EITL) approach, where AI suggests mappings, and human experts review and refine them to ensure accuracy.

Once the requirements are mapped, the next logical step is automating the collection and validation of evidence.

Evidence Collection and Validation

After the requirements are mapped, AI takes over the labor-intensive task of evidence collection. By integrating directly with an organization’s technology stack – such as cloud platforms, identity and access management systems, collaboration tools, and HR systems – AI can automatically gather the necessary data via APIs. For older systems lacking native integrations, AI agents use RPA (Robotic Process Automation) or UI capture to retrieve documentation.

A major shift in compliance operations comes with the move from periodic snapshots to continuous monitoring. AI agents conduct thousands of checks hourly or daily to verify that controls remain effective. For instance, they can confirm that multi-factor authentication is active or that database encryption is in place. If a control fails – such as an S3 bucket becoming public or MFA being disabled – the system automatically creates remediation tickets or sends alerts to the appropriate team members via collaboration tools.

To ensure reliability and prevent AI errors, leading platforms use a hybrid validation system. Deterministic code handles technical verifications, while AI focuses on narrative documentation and explanations. Each piece of evidence is tagged with metadata, including timestamps, sources, and collection methods, creating a tamper-proof audit trail.

The efficiency gains are striking. Organizations using automated compliance tools report spending 82% less time on compliance tasks per framework. AI-powered data mapping can reduce the time spent on evidence preparation from 2,000 hours annually to just 100 hours. While traditional SOC 2 audit preparation takes 3–6 months, AI-driven platforms can achieve audit-readiness in just 24 hours for Type I audits.

AI-Assisted Report Generation

In the final phase of the compliance lifecycle, AI transforms the collected evidence into polished, auditor-ready documentation. AI can draft control narratives that explain how specific safeguards meet regulatory requirements, complete with detailed evidence logs and timestamps. These platforms also simplify vendor questionnaires by automatically filling them with up-to-date policies and evidence, saving hours of manual effort.

AI also generates executive summaries and real-time dashboards that present a clear overview of the organization’s compliance status. These dashboards provide progress updates and trend insights, allowing executives to assess the current compliance posture without diving into technical details.

The speed of AI-driven documentation is impressive – 60–80% faster than traditional methods. For example, Persona AI’s CTO shared that after struggling to reach 30–40% progress on a SOC 2 audit using traditional methods over four months, switching to an AI-powered platform enabled audit-readiness in just a few days. Modern platforms can even create Trust Centers – public-facing portals that display an organization’s live security posture and certifications, turning compliance into a visible business asset.

Key Certifications and AI-Driven Reporting

SOC 2 Compliance

AI has revolutionized the way organizations prepare for SOC 2 compliance, turning what used to be a months-long process into a faster, more efficient workflow. By connecting directly to cloud providers, HR systems, and SaaS applications through APIs, AI tools can automatically collect logs and configuration data. These systems continuously check for compliance issues, such as disabled multi-factor authentication (MFA) or misconfigured storage buckets, and send immediate alerts to help teams stay audit-ready at all times.

Another major benefit is AI’s ability to generate the required System Description (DC-200 criteria) automatically. It maps out a company’s architecture, service commitments, and data flows with precision.

The cost savings are impressive. Traditional SOC 2 preparation typically costs between $50,000 and $100,000. With AI-powered platforms, expenses drop to just $5,000–$15,000, and companies spend 82% less time on compliance tasks.

| Phase | Manual Process | AI Process |

|---|---|---|

| Readiness Assessment | 1–2 Months | 1 Day (Automated Analysis) |

| Remediation | 2 Months | 1–6 Days (AI-Guided) |

| Evidence Collection | Manual/Quarterly Scrambles | Continuous/Real-time APIs |

| System Description | Manual Drafting (Weeks) | AI-Generated (Minutes) |

| Total Prep Time | 6–9 Months | 24 Hours (Type I) / 14 Days (Type II) |

This efficiency not only simplifies SOC 2 compliance but also paves the way for AI to transform other standards like ISO 27001 and PCI DSS.

ISO 27001 and PCI DSS

AI continues to simplify compliance for standards like ISO 27001 and PCI DSS by automating the monitoring and enforcement of control requirements. These systems keep a constant eye on infrastructure, identifying non-conformities in Information Security Management Systems (ISMS) and generating policies that align with standard requirements. AI can even map a single control to satisfy multiple standards, such as ISO 27001, HIPAA, and PCI DSS.

For PCI DSS, AI automates critical tasks like log reviews and quarterly reporting. It identifies unencrypted cardholder data in real time and tailors security protocols to fit each organization’s payment processing environment. While traditional ISO 27001 preparation can take 6–12 months, AI reduces this timeline to as little as 14 days. Similarly, PCI DSS preparation, which usually takes 6–12 months, can now be completed in just 2–4 weeks.

HIPAA Compliance in Healthcare

AI’s impact isn’t limited to financial and data security standards – it’s also transforming compliance in healthcare. With the unique challenges of monitoring Protected Health Information (PHI) and maintaining detailed audit logs, healthcare organizations benefit greatly from AI’s ability to track PHI access in real time. Unauthorized attempts to view patient records are flagged instantly, and comprehensive audit logs required by HIPAA regulations are generated automatically. This real-time monitoring allows healthcare providers to respond quickly to potential breaches.

The financial advantages are clear, too. In 2025, one software company gained over $500,000 in Annual Recurring Revenue within a week by using AI to achieve SOC 2 and HIPAA compliance – a key factor in securing enterprise deals. AI also streamlines the creation of customized privacy and incident response plans, cutting HIPAA preparation timelines from 4–8 months to just 7 days.

sbb-itb-9b7603c

How AI Agents Cut Compliance from DAYS to MINUTES | Use Cases in Finance

Governance, Risk, and Trust Considerations

Building on the earlier discussion of system architecture and compliance automation, this section delves into the key governance and operational risks that shape effective AI-powered compliance reporting.

Ensuring Data Privacy and Security

Safeguarding compliance data requires a solid framework of security measures. The NIST SP 800-53 catalog offers a detailed set of controls tailored for AI-driven environments. For instance, Access Control (AC) limits system access strictly to authorized individuals, while Audit and Accountability (AU) ensures every AI-generated output and user action is logged for transparency and traceability. For organizations managing sensitive data, controls like PII Processing and Transparency (PT) help address privacy risks and align with U.S. laws such as the Privacy Act.

The NIST SP 800-37 Risk Management Framework (RMF) outlines seven lifecycle steps for managing AI systems: Prepare, Categorize, Select, Implement, Assess, Authorize, and Monitor. Real-time monitoring plays a critical role, especially under regulations like the SEC’s four-day reporting rule. To protect compliance data, organizations should implement encryption for both stored and transmitted data, alongside strict authentication protocols.

Once these data protection measures are in place, the focus shifts to addressing risks tied to heavy reliance on AI.

Mitigating Operational Risks

Relying too heavily on AI introduces significant operational risks in compliance reporting. If human operators skip reviewing AI recommendations, organizations could face regulatory challenges when the system makes non-compliant decisions. To avoid automation bias, human oversight is essential – especially for materiality assessments that must meet tight SEC reporting deadlines.

"Agentic AI systems should assist human compliance professionals rather than replace them to provide quick responses and precise accuracy alongside continuous large-scale monitoring." – Nishant Sonkar, Cybersecurity and Compliance Professional

Another major risk comes from non-human identities. AI agents and machine identities often manage sensitive compliance tasks, yet nearly half of all data breaches (49%) stem from password vulnerabilities. To mitigate this, organizations should adopt Human-in-the-Loop (HITL) processes for high-stakes decisions involving regulatory or financial risks. Additionally, governing the lifecycle of machine identities – from creation to decommissioning – helps prevent these AI systems from becoming security risks.

These challenges highlight the importance of robust governance practices for AI systems.

Best Practices for AI Governance

Strong AI governance begins with embedding compliance into every phase of AI development. Frameworks like NIST, ISO 27001, SOC 2, and HIPAA should serve as foundational guides, rather than being treated as afterthoughts. Security teams should establish clear RACI models that assign specific roles to CISOs, legal teams, and compliance officers. For example, when an AI tool flags a potential breach, these defined roles ensure that materiality assessments and reporting deadlines – such as the SEC’s four-day rule – are handled efficiently.

Algorithmic accountability is another critical element, requiring organizations to treat AI systems as stakeholders. This involves conducting internal audits, third-party assessments, and continuous validation to ensure AI outputs remain accurate and reliable, even as data environments evolve. Regular drift assessments are essential for this purpose.

Additionally, applying the principle of least privilege for AI ensures that AI agents only have access to the minimum permissions necessary for their tasks. End-to-end encryption further secures all communications involving AI agents. Together, these practices not only enhance trust but also preserve the efficiency gains that make AI-powered compliance reporting so effective.

The Future of AI in Compliance Reporting

AI is transforming how security teams handle compliance, moving from periodic audits to continuous, real-time monitoring. This shift is gaining momentum: while 84% of enterprises plan to boost investments in AI agents by 2026, only 18% of CISOs have adopted GenAI tools in their compliance programs so far. This gap hints at a major wave of adoption yet to come, paving the way for agentic AI solutions.

Agentic AI does more than just identify compliance gaps – it actively suggests and even initiates corrective actions, all under human oversight. For instance, in November 2025, HSBC rolled out an AI-driven system that processes over a billion transactions monthly. This system flags two to four times more activity than traditional methods while cutting false positives by 60%. Organizations using AI agents for compliance are reporting impressive time savings, with teams reclaiming an average of four hours per week from manual tasks. Some have even halved the time spent on responding to security questionnaires.

"The next frontier is agentic AI. Systems that not only flag compliance issues and alert you but recommend and even initiate corrective actions under your supervision." – Stephen Ferrell, Chief Strategy Officer, Strike Graph

Platforms like The Security Bulldog are taking these advancements further by offering AI-powered tools that help security teams interpret threats faster and make smarter decisions. Using a proprietary NLP engine, these platforms distill vast amounts of open-source cyber intelligence into actionable insights. They integrate seamlessly with existing SOAR and SIEM tools, providing a unified, real-time view of an organization’s security posture.

The productivity gains from AI in compliance are hard to ignore. On average, AI increases the efficiency of compliance tasks by 66% and reduces the effort required to write control implementations by up to 92%. In 2024, 89% of professionals in risk, fraud, and compliance roles viewed AI as a "force for good". Rather than replacing human judgment, AI is enabling teams to focus on strategic oversight and high-value decisions, pushing the industry toward fully integrated, real-time compliance ecosystems.

FAQs

How does AI enhance the efficiency and accuracy of compliance reporting?

AI is reshaping compliance reporting by streamlining tasks such as data collection, analysis, and report creation. What used to take weeks – or sometimes months – can now be wrapped up in just a few hours.

By cutting down on manual processes, AI reduces the risk of human error and ensures reports are consistently precise and ready for audits. This doesn’t just save valuable time; it also brings greater confidence in meeting regulatory standards with accuracy.

What are the risks of over-relying on AI for compliance reporting?

AI has the potential to make compliance reporting faster and more efficient, but leaning too heavily on it can bring about certain challenges. For instance, less human oversight might mean missing nuances or making errors that require human judgment to catch. There’s also the issue of AI occasionally generating biased or unclear decisions, which can make it tough to explain or defend the results. On top of that, high false-positive rates can overwhelm teams with unnecessary alerts, and AI might struggle to keep up with minor regulatory shifts, which could lead to non-compliance and even penalties.

To address these challenges, it’s crucial to strike a balance – leveraging AI’s capabilities while ensuring human expertise is actively involved. This combination helps maintain thorough oversight and provides the flexibility needed to adapt to changing regulations.

How can AI tools support compliance with frameworks like SOC 2 and ISO 27001?

AI-powered compliance tools make it easier to stick to frameworks like SOC 2 and ISO 27001 by automating essential tasks. These tools link framework controls directly to your organization’s assets, policies, and tools, turning static checklists into dynamic, actionable workflows. They also keep a constant eye on your systems, gathering evidence such as logs, screenshots, and configuration snapshots, while flagging potential issues early. This approach not only saves time but also helps minimize errors.

With AI, teams can pinpoint gaps as they happen, tackle problems before audits, and even auto-generate reports and policies. Tools like The Security Bulldog take this a step further by seamlessly integrating with your existing security systems. They automate evidence collection and ensure compliance remains a continuous, smooth process – all without interrupting your current workflows.